The Intersection of Accounting and Data Analytics

In today’s digital age, the fields of accounting and data analytics are becoming increasingly intertwined. Accounting has long been a crucial aspect of business operations, focusing on financial transactions, reporting, and compliance. On the other hand, data analytics involves extracting insights from vast amounts of data to drive strategic decision-making.

By combining accounting principles with data analytics techniques, businesses can gain a deeper understanding of their financial performance and make more informed choices. Here are some ways in which accounting and data analytics intersect:

Financial Forecasting

Data analytics can enhance traditional financial forecasting methods by analysing historical data trends, market conditions, and other variables to predict future financial outcomes more accurately. This can help businesses anticipate potential risks and opportunities, enabling proactive decision-making.

Fraud Detection

Data analytics tools can detect anomalies in financial transactions that may indicate fraudulent activities. By analysing patterns and outliers in the data, accountants can identify potential fraud risks early on and take appropriate measures to mitigate them.

Performance Analysis

Data analytics allows for a more granular analysis of business performance metrics beyond standard financial reports. By leveraging advanced analytics techniques, accountants can uncover insights into cost drivers, revenue streams, profitability ratios, and other key performance indicators to drive operational efficiency.

Compliance Monitoring

Data analytics plays a crucial role in ensuring regulatory compliance by automating monitoring processes and flagging any discrepancies or non-compliance issues in real-time. This helps businesses maintain transparency and integrity in their financial reporting practices.

Strategic Decision-Making

By combining accounting expertise with data-driven insights, businesses can make strategic decisions backed by evidence-based analysis. Data analytics empowers accountants to provide valuable recommendations for improving financial performance, mitigating risks, and capitalising on growth opportunities.

In conclusion, the integration of accounting and data analytics represents a significant opportunity for businesses to enhance their financial management practices and drive sustainable growth. By leveraging the power of data-driven insights alongside traditional accounting principles, organisations can stay ahead in today’s competitive landscape.

Exploring the Impact of Data Analytics on Accounting: Key Roles, Benefits, and Essential Skills

- What is the role of data analytics in accounting?

- How can data analytics improve financial forecasting in accounting?

- What are the benefits of integrating data analytics into accounting processes?

- How does data analytics help in detecting and preventing fraud in accounting?

- What skills are essential for professionals working at the intersection of accounting and data analytics?

What is the role of data analytics in accounting?

Data analytics plays a pivotal role in modern accounting practices by offering valuable insights into financial data that go beyond traditional accounting methods. By leveraging advanced analytical tools and techniques, data analytics enables accountants to extract meaningful patterns, trends, and anomalies from vast amounts of financial information. This allows for more accurate financial forecasting, enhanced fraud detection capabilities, in-depth performance analysis, real-time compliance monitoring, and data-driven decision-making. Ultimately, the integration of data analytics in accounting empowers organisations to improve operational efficiency, mitigate risks, and drive strategic growth based on evidence-based insights derived from their financial data.

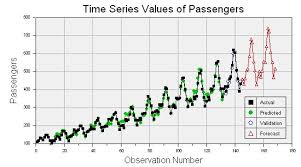

How can data analytics improve financial forecasting in accounting?

Data analytics plays a pivotal role in enhancing financial forecasting within accounting by leveraging historical data trends, market indicators, and other relevant variables to provide more accurate and insightful predictions. By utilising advanced analytics tools and techniques, accountants can identify patterns, anomalies, and correlations within financial data that traditional forecasting methods may overlook. This enables businesses to forecast future financial outcomes with greater precision, anticipate potential risks and opportunities, and make proactive decisions based on data-driven insights. Ultimately, data analytics empowers accountants to refine their forecasting models, enhance forecasting accuracy, and contribute to more informed strategic planning within the realm of accounting.

What are the benefits of integrating data analytics into accounting processes?

Integrating data analytics into accounting processes offers a myriad of benefits for businesses. By harnessing the power of data analytics, organisations can gain deeper insights into their financial data, enabling more accurate forecasting, improved fraud detection capabilities, enhanced performance analysis, streamlined compliance monitoring, and informed strategic decision-making. This integration not only enhances operational efficiency but also empowers businesses to proactively identify risks and opportunities, ultimately driving better financial outcomes and sustainable growth.

How does data analytics help in detecting and preventing fraud in accounting?

Data analytics plays a crucial role in detecting and preventing fraud in accounting by enabling a comprehensive analysis of financial data to identify irregular patterns or anomalies that may indicate fraudulent activities. By leveraging advanced data analytics tools and techniques, accountants can scrutinise large volumes of transactional data to uncover suspicious trends or discrepancies that might go unnoticed through traditional auditing methods. Through continuous monitoring and real-time alerts, data analytics provides an effective mechanism for early detection of potential fraud risks, allowing businesses to take prompt corrective actions and implement preventive measures to safeguard their financial integrity.

What skills are essential for professionals working at the intersection of accounting and data analytics?

Professionals operating at the intersection of accounting and data analytics require a unique blend of skills to excel in this dynamic field. Essential competencies include a strong foundation in accounting principles to understand financial data and reporting standards effectively. Additionally, proficiency in data analytics tools and techniques, such as data mining, statistical analysis, and data visualization, is crucial for extracting meaningful insights from complex datasets. Problem-solving skills, attention to detail, critical thinking, and the ability to communicate findings clearly are also essential for professionals navigating the complexities of merging accounting with data analytics successfully. Adaptability to technological advancements and a continuous learning mindset are key attributes for staying abreast of industry trends in this evolving landscape.